6 Things You Must Know Before You Buy

"Subtle changes in the way you approach mortgage shopping, and even small differences in the way you

structure your mortgage, can literally cost or save you thousands of dollars and years of expense."

Mortgage Regulations Have Changed . . .

Mortgage regulations have changed significantly over the last few years making your options wider than

ever. Subtle changes in the way you approach mortgage shopping and even the small differences in the

way you structure your mortgage can literally cost or save you thousands of dollars and years of expense.

Get the Right Information

Whether you are about to buy your first home, or are planning to make a move to your next home, it is critical that

you inform yourself about the factors involved.

you inform yourself about the factors involved.

Industry research has revealed 6 common mistakes that most homebuyers make when mortgage shopping and they

can have a significant impact on the outcome of this critical negotiation. If handled correctly, these issues could

result in a mortgage that will cost you less over a shorter period of time.

6 Things You Must Know Before Obtaining a Mortgage

Before you commit your hard earned dollars to monthly mortgage payments, consider these 6 issues. Effective

consideration of these important areas can make your payments work much harder for you.

consideration of these important areas can make your payments work much harder for you.

1. You can, and should, get pre-approved for a mortgage before you go looking for a home

Pre-approval is easy, and can give you complete peace-of-mind when shopping for your home. Your local lending

institution can provide you with written pre-approval for you at no cost and no obligation, and be done quite easily

over-the-phone. More than just a verbal approval from your lending institution, a written pre-approval is as good as

money in the bank. It entails a completed credit application and a certificate, which guarantees you a mortgage to

the specified level when you find the home you’re looking for.

2. Know what monthly dollar amount you feel comfortable committing to

When you discuss mortgage pre-approval with your lending institution, find out what level you qualify for and also

pre-assess for yourself what monthly dollar amount you feel comfortable committing to. Your situation may give you

a pre-approval amount that is higher (or lower) than the amount of money you would want to pay out each month.

By working back and forth with your lending institution to determine what this monthly amount is, and what value of

home this translates into at today’s rates, you won’t waste time looking at homes that are not in your price range.

3. You should be thinking about your long term goals and expected situation, to determine the type of mortgage that will best suit your needs

There are a number of questions you should be asking yourself before you commit to a certain type of mortgage;

How long do you think you will own this home? What direction are interest rates going in and how quickly? Is your

income expected to change (up or down) in the near term, impacting how much money you can afford to pay to your

mortgage? The answers to these and other questions will help you determine the most appropriate mortgage you

should be seeking.

4. Make sure you understand what prepayment privileges and payment frequency options are available to you

More frequent payments (for example weekly or biweekly) can literally shave years off your mortgage. By simply

structuring your payments so that they come out more frequently, it will significantly lessen the amount of interest

that you will be charged over the term.

For the same reason, authorized pre-payment of a certain percentage of your mortgage, or an increase in the

amount you pay monthly, will have a major impact on the number of years you will have to pay and could shorten

your payment term considerably.

These two payment options can cut years off your mortgage, and save you thousands of dollars in interest.

However, not every mortgage has these pre-payment privileges built in, so make sure you ask the proper

questions.

5. Ask if your mortgage is both portable and/or assumable

A portable mortgage, where available, is one that you can carry with you when you buy your next home and avoid

paying any discharge penalties. This means that you will not have to go through the entire mortgage process again

unless you are making a move up to a much more expensive home.

An assumable mortgage is one that the buyer for your home can take over when you move to your next home. This

can be a very powerful tool at the negotiating table, making it much easier and more desirable for a buyer to buy

your home, and again saves you any discharge penalties.

6.You should seriously consider dealing with a Mortgage Expert

Consider dealing only with a professional who specializes in mortgages. Enlisting their services can make a

significant difference in the cost and effectiveness of the mortgage you obtain. For example they can make the

process faster thereby avoiding costly delays. Typically there is no cost or obligation to inquire.

By having an understanding of these 6 problem areas as you walk through your home, you'll be arming yourself against future disappointment.

Categories

Recent Posts

Are you ready to buy a home?

Fully Furnished Home on Market for Sale!!

Back On Market - 435 E Logan Ave

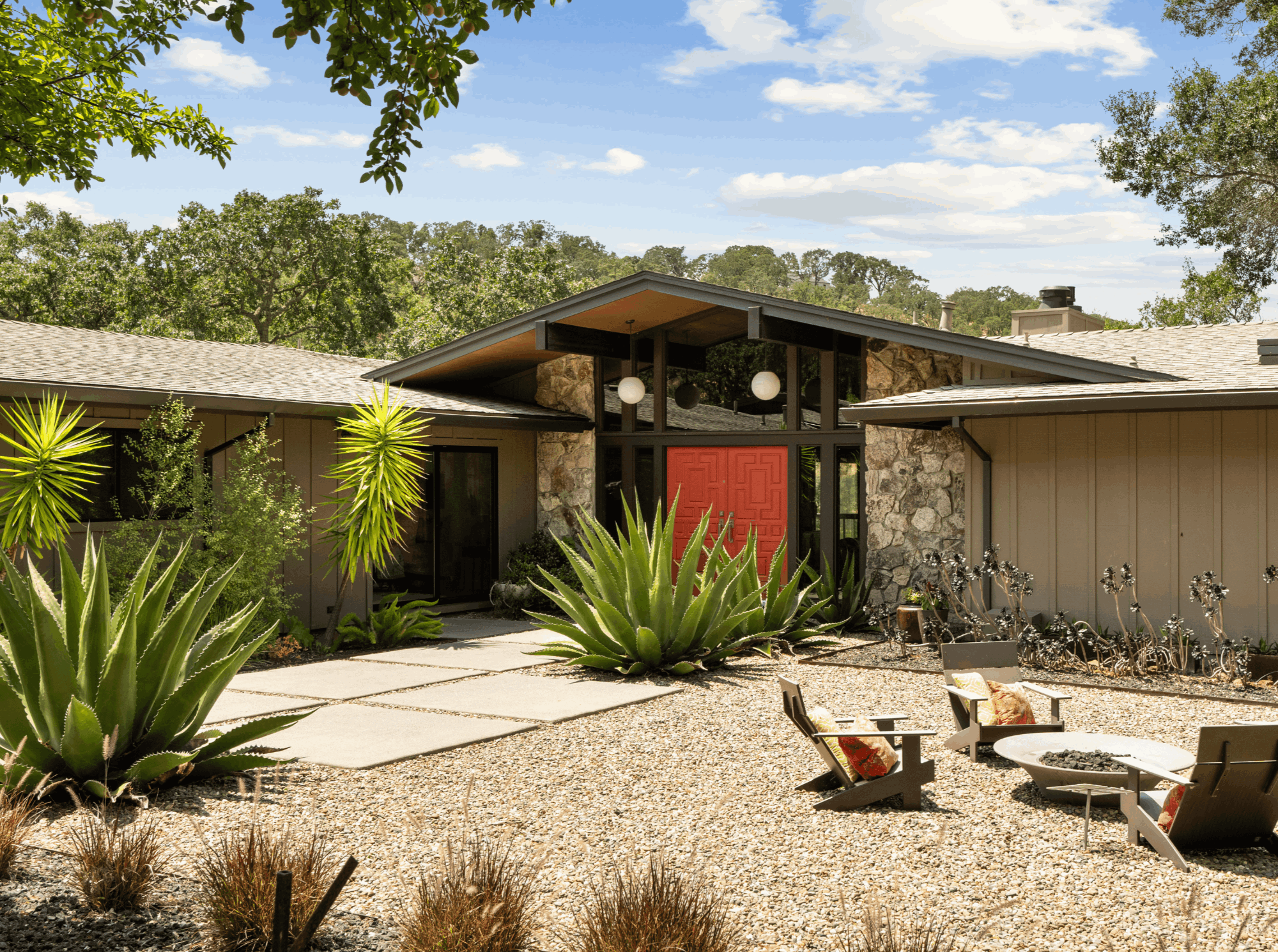

Secluded Mid-Century Modern Napa Valley Estate Presented by Stefan Jezycki

Elevate Home Services

The 9 Step System to Get Your Home Sold Fast and For Top Dollar

27 Tips You Should Know To Get Your Home Sold Fast and For Top Dollar

11 Things You Need to Know to Pass Your Home Inspection

Moving Countdown Checklist

10 Things You Need to Know Before You Hire an Agent